If in accounting an organization creates a reserve for doubtful debts, then write off bad debts only at the expense of this source.

Write-off procedure

Write off uncollectible receivables in the following order:

- collect all the documents that allow you to recognize the debt as uncollectible (primary documents, contracts, letters of claims against the debtor, extracts from the Unified State Register of Legal Entities or certificates from the tax inspectorate on the liquidation of the debtor, court decisions and other documents);

- spend inventory receivables and determine the debt of counterparties for which the limitation period has expired (which is unrealistic for collection on other grounds);

- prepare an accounting statement justifying the need to write off the debt;

- issue an order from the head to write off accounts receivable.

This procedure is provided for in paragraph 77 of the Regulation on accounting and reporting.

Accounting: use of the reserve

Operations related to the creation and use of a reserve for doubtful debts are recorded on account 63 “Reserves for doubtful debts”.

In accounting, the write-off of receivables at the expense of the allowance for doubtful debts reflect the posting:

Debit 63 Credit 62 (71, 73, 76...)

- uncollectible accounts receivable were written off at the expense of the created reserve.

You can use the reserve only within the limits of the reserved amounts. If during the year the amount of expenses for writing off bad debts exceeds the amount of the created reserve, reflect the difference as part of other expenses (paragraph 11 of PBU 10/99).

When writing off the difference, make a posting:

Debit 91-2 Credit 62 (71, 73, 76...)

- written off uncollectible receivables not covered by the provision.

Writing off bad debt is not debt cancellation. Therefore, within five years from the date of write-off, reflect it behind the balance on account 007 “Debt of insolvent debtors written off at a loss” (Instructions for the chart of accounts):

Debit 007

- Accounts receivable written off.

During this period, monitor the possibility of its recovery in case of a change in the property status of the debtor (clause 77 of the Regulations on Accounting and Reporting).

An example of the reflection in accounting of the use of a reserve for doubtful debts

Alfa CJSC quarterly conducts an inventory of receivables and makes deductions to the reserve for doubtful debts in accounting.

The unused balance of the reserve for doubtful debts for the 1st quarter of 2013 amounted to 45,400 rubles.

According to the results of the inventory as of June 30, 2013, the organization's records included:

1) doubtful receivables of organizations:

- LLC “Torgovaya firm “Germes”” - 170,700 rubles. The maturity of the debt is April 9, 2013, the delay period was 82 days;

2) bad debt of OAO Production Company Master in the amount of 45,400 rubles. In the II quarter, the Master's debt was recognized as uncollectible due to the liquidation of the debtor organization (confirmed by an extract from the Unified State Register of Legal Entities). As at 30 June 2013, the arrears were 379 days in arrears. Previously, the amount of debt was fully taken into account when forming the reserve.

According to the results of the inventory as of June 30, 2013, Alpha's accountant included the debt of Hermes in the amount of 170,700 rubles into the reserve for doubtful debts.

Bad debt "Master" was completely written off at the expense of the reserve.

In the accounting of Alpha, the reserve was formed in the amount of 170,700 rubles.

Taking into account the balance of the reserve as of March 31, 2013 and the write-off of Master's bad debt, the additional amount of expenses for the formation of the reserve in the II quarter of 2013 amounted to:

45 400 rub. + 170 700 rub. - 45 400 rubles. = 170,700 rubles.

Debit 91-2 Credit 63

- 170,700 rubles. - reflects the costs of forming a reserve for doubtful debts;

Debit 63 Credit 62

- 45 400 rubles. -

written off uncollectible receivables from the allowance.

If by the end of the year following the year in which the reserve for doubtful debts was created, the reserve is not used, then include the unused amounts in other income. This procedure is provided for in paragraph 70 of the Regulation on accounting and reporting.

In accounting, make a posting:

Debit 63 Credit 91-1

- restored unused reserve for doubtful debts.

An example of the reflection in accounting of the recovery of the unused part of the reserve for doubtful debts

Alfa CJSC quarterly conducts an inventory of receivables and makes deductions to the reserve for doubtful debts in accounting. The unused balance of the reserve for doubtful debts of Alfa for the nine months of 2013 amounted to 45,400 rubles. The reserve was formed at the beginning of 2013 for doubtful receivables of OAO Production Company Master.

On December 19, 2013, Master transferred 45,400 rubles to Alfa's settlement account. and thereby paid off his debt. According to the results of the inventory as of December 31, 2013, Alfa has no doubtful debts. Therefore, in the accounting of Alpha, the reserve was restored.

Debit 63 Credit 91-1

- 45 400 rubles. - the amount of the restored reserve for doubtful debts is reflected in the composition of income.

On the peculiarities of spending the reserve for doubtful debts in the taxation of profits, see. How to use the allowance for doubtful debts in tax accounting .

The functioning of any organization is impossible without dealing with overdue debts of its debtors. In order for the data on existing debts to be reliable in accounting and tax reporting, and the very existence of these debts does not threaten the financial and economic stability of the enterprise, a reserve for doubtful debts (RSD) is created. Let's talk more about this concept.

The legislative framework

As part of accounting, the creation of a reserve for doubtful receivables in relation to any DZ classified by a specialist as a class of doubtful is mandatory for each organization. The basic regulations for working with RSD are contained in the following regulatory documents:

- part two of the Tax Code of the Russian Federation;

- Federal Law No. 117 as amended on December 29, 2014 with add. and amendments that came into force on March 1, 2015;

- Regulations on accounting and financial reporting in the Russian Federation, put into circulation by order of the Ministry of Finance No. 34n on July 29, 1998;

- PBU 4/99 "Accounting statements of the organization", which was approved by order of the Ministry of Finance No. 43n on July 6, 1999;

- Order of the Ministry of Finance No. 49 as amended on November 8, 2010;

- Accounting regulation on changing estimates No. 21/2008, which was approved on October 6, 2008 by order of the Ministry of Finance of the Russian Federation No. 106n.

Attention! Doubtful debt is the debt of one of the clients or counterparties of the organization, which was not repaid by him within the period established by contractual obligations or by law. Also referred to as doubtful are receivables that are not secured by any guarantees, such as a pledge or deposit, a bank guarantee or guarantee, etc., which, according to an expert assessment, the counterparty will not be able to close at the right time for the creditor.

Creation of RSD: rules and features

The reserve for doubtful debts is formed by the company based on the results of an inventory of its receivables. The accountant must carry out the inventory on the last day of the reporting period, and the act on its results becomes the documentary basis for further actions with RSD. For each debtor discovered during the verification process, an analysis of his financial position is carried out, and then the probability that the funds under the contract will be paid by him on time is determined. Using the data obtained, the size of the reserve required for each of the debtors is calculated.

Methods for creating a provision for doubtful debts

For the formation of RSD, depending on the situation, one of three methods is used:

- interval- the amount of regular deductions to the RSD is calculated by the accountant with a certain frequency (once a month or quarter). When calculating, determine the percentage of the total amount of debt, taking into account the duration of its existence.

- Expert- based on the analysis of the behavior and financial condition of the debtor, the company's economists determine which part of the total amount of doubtful debts he has, he will be able to repay on time. In this case, the RSD for this debtor is determined as the difference between the existing debt and the planned repayment amount.

- Statistical– an analysis is being made of the legal entity's remote sensing for each type over the past few years. Based on the analysis, the average annual amount of the company's receivables is determined. It is in its size that the reserve fund is formed.

Must be remembered! When calculating the size of RSD, the amount of debt is taken including VAT.

When choosing the methods and methods by which the allowance for doubtful debts will be calculated, an entrepreneur should take into account the specifics of the activity and accounting features of his company. In addition, it is necessary to take into account the impact RSD will have on the main indicators of accounting and tax reporting. The selected methods should be displayed in the accounting policy of the organization. For example, for the expert method, it will be necessary to clearly establish the criteria for assessing the financial condition of debtor companies, and for the interval method, the amount of interest that will be deducted to the reserve.

By the way! You can use the percentage values used in tax accounting. According to them, the amount of the RSD can be half the amount of the total debt if it arose 45–90 days ago, or 100% for the DZ older than 90 days.

Required documents

In the event of any doubtful DZ, the accountant of the company is obliged to create an appropriate RSD. Depending on the type of accounting policy chosen by the company, the following can serve as a documentary basis for transferring receivables to the category of doubtful:

- reference-calculation compiled by an accountant;

- expert opinion from an economist;

- professional judgment.

This document is submitted to the head of the enterprise. After getting acquainted with it, the head issues an order to create the corresponding RSD in the accounting of the organization. The order must include:

- the full amount of DZ;

- the full name of the enterprise through whose fault the debt arose;

- RSD size;

- Full name and position of the person responsible for the formation of the reserve.

Only on the basis of this document can the accountant of the company proceed with further actions.

Rules for displaying RSD in financial statements

In accounting for postings using a reserve for doubtful receivables, account 63 is used. To form a reserve, posting: Debit 91/2 "Other expenses"— Loan 63. Further deductions to the RSD account are also written off as other expenses.

Important! The volume of RSD within the framework of accounting is not limited.

In the balance sheet of a legal entity, data on remote control are displayed minus the volumes of the generated RSD. The final figure is entered in line 1230.

In case of repayment (both full and partial) of the debt by the debtor, RSD may be subject to recovery. In this situation, its amount is added to the other income of the enterprise and is credited to account 91. It is also possible to restore RSD if, following the results of the year following the year of its creation, a lack of payment from the debtor is found. The recovery procedure here is the same as for the redemption of DZ.

If the receivable has moved from the category of doubtful to the category of uncollectible, it is debited from the balance sheet of the enterprise at the expense of RSD. Before this, an inventory of doubtful RDs is carried out, as well as the preparation of documents proving the hopelessness of the debt. Write-off is carried out to the address of the 62nd account.

Important! Even after the write-off of DZ, it is necessary to monitor the financial situation of the debtor for five years in order to identify the possibility of recovering the amounts written off.

Features of working with RSD in tax accounting

The tax code limits the amount that an enterprise has the right to allocate to a reserve for doubtful debts. This can be no more than 10% of the company's revenue received in the period for which the RSD was created. In this case, the value of revenue for calculations is taken without VAT. Recall that there are no such restrictions in accounting.

Important! The amount of contributions to the reserve, within the specified tax limits, each entrepreneur sets for his company independently. Limit values are prescribed by the organization in the accounting policy.

In addition, there are other differences in the use of RSD in tax and accounting. Thus, according to the provisions of accounting, the creation of a reserve is mandatory for each doubtful receivable. Tax accounting leaves this possibility at the discretion of the accountant. That is, according to its rules, the formation of RSD moves from the category of duties to the category of company rights.

By the way, within the framework of tax accounting, DZ is recognized as doubtful only if it meets all the requirements listed below:

- not paid in due time;

- not supported by warranty;

- associated with payment for the supply of goods/works/services;

- is not a refund of the advance;

- not related to the payment of contractual sanctions;

- is not a payment for property claims or rights transferred by the company.

If at least one of the above conditions is not met, the Tax Code of the Russian Federation prohibits the formation of a reserve for such receivables.

Important! If an entrepreneur works under a simplified taxation system, the formation of RSD, in accordance with the requirements of the Russian Tax Code, is impossible for him.

Accounting allocates the amount of deductions to RSD at the discretion of the creditor company. But tax accounting strictly limits them, depending on the duration of the delay:

- 0% - if the DZ exists for less than 45 days;

- 50% - for DZ formed from 45 to 90 days ago;

- 100% - for overdue payments that occurred more than 90 days ago.

Attention! In tax accounting, the costs of replenishing RSD are considered non-operating expenses of the company.

The size of the RSD is determined based on the results of the inventory of receivables. This procedure is recommended to be carried out on the last day of the tax period. If a company works on an advance payment scheme, for it the frequency of inventory of remote sensing is 1 month. All other taxpayers clarify the amount of reserves and receivables on a quarterly basis. This is also important for the correct display in tax documents of the write-off of RSD, if it occurred due to the expiration of the limitation period for the debt. The write-off procedure should be carried out in the same reporting period when the debt collection period expired, and not when the company's employees found time for an inventory. This requirement is fixed by the letter of the Ministry of Finance of the Russian Federation No. 03-03-06 / 1/38 dated January 28, 2013.

Important! The data on the write-off of DZ in the tax and accounting reports must match! Otherwise, the company's accountant will have to adjust the already submitted tax returns.

In contact with

Doubtful debt is a debt to the organization, which with a high probability will not be repaid in full or in part.

This is evidenced, in particular:

or violation by the debtor of the payment term;

or information about the financial problems of the debtor.

Any doubtful debt can be recognized, including those reflected in the debit of accounts,,,.

Also, the borrower's debt on the issued loan, reflected on sub-account 58-3 "Granted loans", may be recognized as doubtful debt.

The allowance for doubtful debts is created so that in the financial statements of the organization the data on its accounts receivable are reliable.

Such a reserve in accounting is an estimated value. Its creation, increase or decrease must be reflected in the composition of expenses or income.

The procedure for creating and using the reserve must be fixed in the accounting policy.

Allowance for doubtful debts and

The basis for creating a provision for doubtful debts is the results of the inventory of receivables on the last day of the reporting period.

The amount of the reserve is determined separately for each debtor. His real financial position and the probability of debt repayment are assessed.

Ways to create a reserve for doubtful debts

The allowance for doubtful debts in accounting is formed as follows:

the debt of counterparties is determined, which was not repaid within the terms specified by the agreements, and is not provided with the necessary guarantees (doubtful debts);

separately for each doubtful debt, the amount for which it is necessary to create a reserve is determined, depending on the financial condition of the debtor and the assessment of the probability of repaying the debt in full or in part.

interval method;

expert way;

statistical way.

interval method

With this method, the amount of deductions to the reserve for doubtful debts is calculated quarterly (monthly) as a percentage of the debt amount, depending on the duration of the delay.

expert way

With this method, a reserve for doubtful debts is created for each doubtful debt in the amount that, in the opinion of the organization, will not be repaid on time.

Statistical way

With this method, the amount of deductions to the reserve for doubtful debts is determined according to data for several years as the share of bad debts in the total amount of receivables of a certain type. For example, the share of unpaid goods by buyers in the total debt of buyers.

Accounting for operations on the creation and use of a reserve for doubtful debts

The accrual or reduction (recovery) of the reserve is drawn up using an accounting statement-calculation.

To calculate the reserve, the amount of the debt is taken into account with VAT.

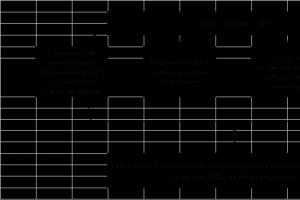

The entries for the creation and use of the allowance for doubtful debts will be as follows:

Allowance for doubtful debts and financial statements

In the financial statements, doubtful debts are reflected as follows:

In the form of doubtful debts in line 1230 of the balance sheet minus the allowance for doubtful debts.

Allocations to the allowance for doubtful debts are reflected in line 2350 "Other expenses" of the income statement.

Allowance for doubtful debts in tax accounting

Allowance for doubtful debts: details for an accountant

- Temporary tax differences in the creation of provisions for doubtful debts

Changes in estimates" the amount of the allowance for doubtful debts is an estimated value. composition of non-operating ... - Encyclopedia of decisions.Expenses for the formation of reserves for doubtful debts for the purposes of taxation of profits; - Encyclopedia ...

- Allowance for doubtful debts: accounting nuances

The taxpayer decided to create a reserve for doubtful debts - the amount of bad debts not covered ..., using the accrual method, for the formation of reserves for doubtful debts (in the manner prescribed by Article 266 ..., that the organization that decided to form a reserve on doubtful debts, writes off bad debts at the expense of ... - Encyclopedia of decisions.

- The procedure for creating a reserve for doubtful debts for debt in conventional units

It is necessary to form deductions to the reserve for doubtful debts in accounting and tax ... using the accrual method, for the formation of reserves for doubtful debts (in the manner prescribed by Art. ... In other words, to create a reserve for doubtful debts, you should: 1. Conduct an inventory. .. must be reserved. When calculating the allowance for doubtful debts during the tax period ... decisions. Expenses for the formation of provisions for doubtful debts for profit tax purposes. Answer ...

- New in reserve for doubtful debts

The Code establishes a standard that the amount of the reserve for doubtful debts cannot exceed 10% of ... profit, due to the fact that the reserve for doubtful debts was restored, since it did not fit ... apply the rule of creating a reserve for doubtful debts to the balance. So I urge you to turn ... and this is done to create a reserve for doubtful debts: this has nothing to do with ...

- We defend in court the right to create a reserve for doubtful debts

Reserve for doubtful debts According to paragraph 3 of Article 266 of the Tax Code of the Russian Federation, the taxpayer has the right to create reserves for doubtful debts ... the legislator, having provided taxpayers with the opportunity to form reserves for doubtful debts before they are recognized as bad, provided ... debts, writing off debts recognized as bad, ... which does not allow the taxpayer to form a provision for doubtful debts in relation to such debts. But...

- Innovations in the procedure for the formation of a reserve for doubtful debts

RF, which established the procedure for creating a reserve for doubtful debts (RSD). The new order will...

- The procedure for writing off accounts receivable under the simplified tax system and OSNO

In the accounting of the organization, a reserve for doubtful debts is created for the amount of this debt. Further ... the taxpayer has decided to create a provision for doubtful debts, writing off debts recognized as bad in ... the organization has decided to create a provision for doubtful debts in relation to a specific debt that has arisen ... composition of non-operating expenses without adjusting the provision for doubtful debts . As part of non-operating expenses can ...

- Income tax in 2018: clarifications of the Ministry of Finance of Russia

- income tax in 2017. Clarifications of the Ministry of Finance of Russia

Account for such debt as a provision for doubtful debts. Letter dated July 17, 2017 ... , respectively, is not taken into account when creating a reserve for doubtful debts as of the reporting date. Letter dated ... The taxpayer-bank (assignee) has the right to form reserves for doubtful debts in respect of debts formed in ...

- Ministry of Finance on the definition of doubtful debt for tax purposes

The Ministry of Finance believed that the calculation of the reserve for doubtful debts should include "accounts receivable" minus .... In view of the foregoing, the taxpayer has the right to form a reserve for doubtful debts in relation to the specified receivables ...) talked about including in the reserve for doubtful debts that part of the receivables that ... would have the right to include in the calculation of the reserve for doubtful debts. From this year, this number ...

- Write-off of receivables in the form of an advance

Whether a provision for doubtful debts has been created for accounts receivable. In accounting, accounts receivable ... accounting statements in the Russian Federation are considered doubtful. The amount of the allowance for doubtful debts is an estimated value, therefore, with ... advances issued. The organization did not create a reserve for doubtful debts in relation to the specified receivables ... a reserve for doubtful debts cannot be created in relation to it (Letter of the Ministry of Finance of the Russian Federation dated 04 ...

- What to look for when preparing annual financial statements for 2017

Issued interest-free loans; provision for doubtful debts has not been created; the estimated liability is not reflected in ... the line "Accounts receivable". A provision for doubtful debts has not been created. Forming annual financial statements, it is necessary ... as a duty. Sometimes they deliberately do not create a reserve for doubtful debts, wanting to overestimate the financial result of their activities ...

- Review of letters from the Ministry of Finance of the Russian Federation for August 2018

When determining the maximum amount of the reserve for doubtful debts calculated based on the results of the tax ... the reserve for doubtful debts formed by the merging company before the merger is subject to inclusion in the reserve for doubtful debts ... of the company being reorganized in the form of merger. At the same time, the amounts included in the reserve for doubtful debts ... the reorganized organization applies the procedure for forming a reserve for doubtful debts in the general manner established ...

- The limitation period has expired on the advance payment listed by the supplier: we restore VAT

Accounts receivable, as well as the creation of a reserve for doubtful debts, is made on the basis of data held ... by creditors. Thus, the timely creation of reserves for doubtful debts, as well as the write-off ... on the debit of account 63 "Reserves for doubtful debts" in correspondence with the corresponding ...

- The creation of RSD from this year has become more attractive!

Art. 266 of the Tax Code of the Russian Federation, the formation of a reserve for doubtful debts (RSD) in 2017 became ... the results are formalized in an act. When forming a reserve for doubtful debts, the taxpayer has the right to take into account the amount of doubtful ... RSD with the balance of the reserve. The amount of the allowance for doubtful debts calculated as of the reporting date (RSDnew ... RSD at the end of the year. The balance of the allowance for doubtful debts can be used as follows...

Doubtful debt is a receivable that has not been repaid or with a high probability will not be repaid within the terms established by the agreement and is not secured by appropriate guarantees. For doubtful debts, the organization must create a reserve ().

How the creation of a reserve for doubtful debts is reflected in accounting, we will tell in our consultation.

Determine the amount of "doubtful" reserve

The size of the reserve must be determined separately for each doubtful debt based on the results of the inventory of calculations. The amount of the reserve will depend on the financial condition of the debtor and the assessment of the likelihood that the debt will be repaid in full or in part (clause 70 of the Order of the Ministry of Finance of July 29, 1998 No. 34n).

The specific procedure for determining the amount of the reserve is established.

To converge accounting and tax accounting, an organization can use when creating a reserve for doubtful debts.

Accounting for allowance for doubtful debts

The created reserve for doubtful debts is attributed to the financial results of the organization as part of other expenses, i.e., it is included in the debit of account 91 “Other income and expenses” (clause 70 of the Order of the Ministry of Finance of July 29, 1998 No. 34n, Order of the Ministry of Finance of October 31, 2000 No. 94n).

When creating and using a provision for doubtful debts, the postings will be as follows.

Yu.V. Kapanina, certified tax consultant

Allowance for doubtful debts

How to calculate it and reflect it in the declaration

ATTENTION

If you have not created a reserve before, you can start doing this from the new year, fixing your decision in the accounting policy. Art. 313 of the Tax Code of the Russian Federation; Letter of the Federal Tax Service for the city of Moscow dated 06/20/2011 No. 16-15 / [email protected] .

Let's consider such a situation. Your company, which uses OSNO, has counterparties who could not pay their obligations on time. As a result, an impressive accounts receivable was formed. In addition, you have doubts that these debts will be returned to you at all. In this case, it makes sense to create a provision for doubtful debts. Art. 266 Tax Code of the Russian Federation. With it, you can quickly take into account possible losses from bad debts in expenses. sub. 7 p. 1 art. 265 Tax Code of the Russian Federation. Also, the reserve will allow you to coordinate the taxation of profits with the real financial condition of your company.

And how to form, use such a reserve and reflect all this in a tax return, you will learn from our article.

Formation of a reserve for doubtful debts

To determine the amount of the reserve, you need to conduct an inventory of receivables on the last day of each reporting (tax) period and paragraph 4 of Art. 266 Tax Code of the Russian Federation, according to the results of which to draw up an act (in a form developed independently, or in a unified form No. INV-17 Art. 9 of the Law of 06.12.2011 No. 402-FZ).

Of all receivables, you need to highlight the one that is doubtful. After all, it is precisely such debts that will participate in the formation of the reserve.

The debt is recognized as doubtful for the purposes of creating a reserve in tax accounting only if the following conditions are met paragraph 1 of Art. 266 Tax Code of the Russian Federation:

- the debt arose in connection with the sale of goods, the performance of work or the provision of services.

The debt formed on other grounds is not doubtful for the purposes of creating a reserve. For example, the debt on the transferred prepayment (advance payment), if the goods were not shipped (works were not performed, services were not provided) by the supplier within the time period established by the contract, to pay sanctions for violation of contractual terms, under loan agreements Letters of the Ministry of Finance dated 09/04/2015 No. 03-03-06/2/51088, dated 10/23/2012 No. 03-03-06/1/562 (p. 4), dated 07/24/2013 No. 03-03-06/1/ 29315 , dated 04.02.2011 No. 03-03-06 / 1/70;

- the debt is not repaid within the terms established by the agreement;

- the debt is not secured by collateral, surety, bank guarantee.

Next, look at the delay period and paragraph 4 of Art. 266 Tax Code of the Russian Federation:

- <если>delay less than 45 calendar days - the debt is not included in the reserve;

- <если>delay from 45 to 90 calendar days (inclusive) - 50% of the debt amount is included in the reserve;

- <если>delay of more than 90 calendar days - the entire amount of the debt is included in the reserve.

Please note that the debt is taken into account together with VAT Letter of the Ministry of Finance of June 11, 2013 No. 03-03-06/1/21726.

At the same time, the size of the created reserve should not exceed 10% of the revenue of the reporting (tax) period (excluding VAT) paragraph 4 of Art. 266 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance dated 04/06/2015 No. 03-03-06/4/19198.

The amounts of deductions to the reserve are included in non-operating expenses for the last day of the reporting (tax) period a paragraph 3 of Art. 266, sub. 7 p. 1 art. 265 Tax Code of the Russian Federation.

Example. Creating a provision for doubtful debts

/ condition / The company first decided to create a reserve for doubtful debts on January 1, 2015. The company's revenue (without VAT) for the 1st quarter of 2015 amounted to 2,600,000 rubles.

/ solution / We calculate the amount of deductions to the reserve in the first quarter based on the amount of debt and the number of days of delay.

Then we will determine the maximum amount of deductions to the reserve based on the amount of revenue. In the first quarter, it will be equal to 260,000 rubles. (2,600,000 rubles x 10%).

Next, we compare the estimated amount of deductions with the limit value. Since 436,000 rubles. > 260,000 rubles, then the reserve in the first quarter is created in the amount of 260,000 rubles. On March 31, 2015, this amount is included in non-operating expenses in full, since no reserve was created before that.

Expenditure in the form of deductions to the created reserve for doubtful debts is not reflected separately. This amount, together with other non-operating expenses, is indicated on line 200 of Appendix No. 2 to sheet 02 of the declaration. Further, the data of line 200 of Appendix No. 2 to sheet 02 are transferred to line 040 of sheet 02 of the declaration.

Reserve transfer

If you did not use (or did not fully use) the created reserve in the reporting (tax) period, then its amount is transferred to the next reporting (tax) period. At the same time, the amount of the newly created reserve in the current quarter should be adjusted for the amount of this unused part and paragraph 5 of Art. 266 Tax Code of the Russian Federation. Then at the end of the next quarter you need:

- again conduct an inventory of debts and identify doubtful ones;

- calculate the amount of the new reserve based on the receivables in the manner similar to that previously described, and taking into account the limitation of 10% of the revenue of the relevant reporting (tax) period;

- compare the amount of the new provision with the balance of the unused (that is, with the amount of the provision created in the previous period, minus the bad debts written off from the reserve):

- <если>the amount of the new reserve is less than the unused balance of the reserve, then the difference is included in non-operating income of the current reporting (tax) period a paragraph 7 of Art. 250, paragraph 5 of Art. 266 Tax Code of the Russian Federation;

- <если>the value of the new reserve is greater than the unused balance, then the difference is included in non-operating expenses of the current reporting (tax) period a sub. 7 p. 1 art. 265, paragraph 3 of Art. 266 Tax Code of the Russian Federation.

Pay attention to the sequence of actions. First you need to compare the estimated amount of deductions to the reserve with the 10% revenue limit and only then adjust the newly created reserve for the balance of the reserve for the previous period. Decree of the Federal Antimonopoly Service of the Moscow Region No. А40-106629/11-91-444 dated September 6, 2013.

Example. Carryover of unused reserve to the next reporting period

/ condition / Let's continue the previous example. Revenue (without VAT) for the half year of 2015 - 4,100,000 rubles. Bad debt was not written off against the allowance in the 1st quarter of 2015. The unused balance of the reserve as of April 1, 2015 is 260,000 rubles.

/ solution / According to the results of the inventory carried out as of June 30, 2015, no new debts appeared. In May Debtor 4 paid for the services rendered.

The delay on all debts is now more than 90 calendar days, therefore, the entire amount of doubtful debts, except for the loan debt, is involved in the formation of the reserve. The estimated amount of deductions to the reserve is 873,000 rubles. (293,000 rubles + 580,000 rubles).

The maximum amount of deductions to the reserve is 410,000 rubles. (4,100,000 rubles x 10%), we create a reserve by this amount, since it is less than the estimated amount of deductions to the reserve (873,000 rubles).

Then we adjust the newly created reserve (410,000 rubles) for the unused balance (260,000 rubles). Since the new reserve is greater than the transferred balance, the difference is 150,000 rubles. (410,000 rubles - 260,000 rubles) are included in non-operating expenses on June 30, 2015

On income tax return the amount of deductions to the reserve (cumulatively 260,000 rubles + 150,000 rubles = 410,000 rubles) is reflected in the total amount of non-operating expenses in line 200 of Appendix No. 2 to sheet 02 of the declaration and line 040 of sheet 02 of the declaration.

Reserve use

The amount of the reserve in tax accounting can be used by the company only to cover losses from bad debts. paragraph 4 of Art. 266 Tax Code of the Russian Federation.

As you know, debts are recognized as bad (unrealistic to collect) paragraph 2 of Art. 266 Tax Code of the Russian Federation if one of the following events occurs:

- <или>the limitation period has expired (in general, it is 3 years from the day you learned or should have learned about the violation of your right, but for some claims, special deadlines are established by law and) articles 196, 197 of the Civil Code of the Russian Federation;

- <или>the debtor organization was liquidated, including excluded from the Unified State Register of Legal Entities as an inactive legal entity Art. 61, paragraph 9 of Art. 63, paragraph 2 of Art. 64.2 of the Civil Code of the Russian Federation; Letters of the Ministry of Finance of January 23, 2015 No. 03-01-10 / 1982, of July 24, 2015 No. 03-01-10 / 42792;

- <или>the obligation was terminated due to the impossibility of its performance (for example, due to force majeure circumstances) or on the basis of an act of a state body (for example, by a court decision, the debtor entrepreneur was declared bankrupt Letter of the Ministry of Finance dated May 25, 2015 No. 03-03-06/1/29969);

- <или>the bailiff issued a decision on the completion of the enforcement proceedings and the return of the writ of execution to the creditor due to the impossibility of recovering Letters of the Ministry of Finance dated March 27, 2015 No. 03-03-06/1/17107, dated July 27, 2015 No. 03-03-06/1/43049.

Thus, if after the accrual of the reserve you recognize any debt as uncollectible, then the amount of this debt is not included in expenses, but is written off from the reserve.

If the created reserve is not enough to cover all bad debts, then the amount by which the bad debt exceeds the reserve must be included in non-operating expenses. sub. 2 p. 2 art. 265, paragraph 5 of Art. 266 Tax Code of the Russian Federation.

Example. Use of the allowance for doubtful debts in the third quarter

/ condition / Let's continue our example. Revenue (without VAT) for 9 months of 2015 - 6,700,000 rubles. The unused balance of the reserve as of July 1, 2015 is 410,000 rubles.

In August, the company received documents on the liquidation of Debtor 2 and its debt was recognized as uncollectible.

/ solution / Recognized as bad debt in the amount of 580,000 rubles. write off the reserve. At the same time, the amount of the formed reserve is 410,000 rubles. insufficient to repay the full amount of the debt. The difference in the amount of 170,000 rubles. (580,000 rubles - 410,000 rubles) will be taken into account in non-operating expenses as of the date of debt cancellation. On September 30, we again conduct an inventory of receivables. The company has no new debts.

The delay on debts is more than 90 calendar days, and the reserve is formed based on the total amount of doubtful debts (excluding loan debt) of 293,000 rubles, which does not exceed the limit value of 670,000 rubles. (6,700,000 rubles x 10%). This means that we are creating a new reserve in the amount of 293,000 rubles.

There is no unused balance of the reserve as of September 30, 2015, that is, in fact, it is equal to zero. Therefore, the entire amount of the new reserve is taken into account in non-operating expenses.

On income tax return reflect:

- deductions to the reserve (in our example, on a cumulative total of 410,000 rubles + 293,000 rubles = 703,000 rubles) in the total amount of non-operating expenses - on line 200 of Appendix No. 2 to sheet 02 of the declaration;

- amounts of bad debts not covered by the reserve (170,000 rubles for our example) - in line 300 (in the total amount of losses equated to non-operating expenses) and line 302 (in a separate amount) of Appendix No. 2 to sheet 02 of the declaration;

- the amount of deductions to the reserve and the part of the bad debt written off directly as expenses (the sum of lines 200 and 300 of Appendix No. 2 to sheet 02 of the declaration) - on line 040 of sheet 02 of the declaration.

If you have a bad debt that did not participate in the formation of a “doubtful” reserve, then the question arises: should you write off such debt from the reserve or can it be taken into account directly in non-operating expenses?

The Ministry of Finance believes that any bad debts are written off at the expense of the reserve Letter of the Ministry of Finance of July 17, 2012 No. 03-03-06/2/78. But YOU have a different position on this issue Resolution of the Presidium of the Supreme Arbitration Court dated 17.06.2014 No. 4580/14. The supreme judges indicated that the norms of the Tax Code on writing off bad debts at the expense of the reserve are applied only when such debt arose as a result of the sale of goods (performance of work, provision of services). Those debts that were formed not in connection with the sale of goods (works, services) and did not participate in the creation of a reserve by virtue of a direct indication of the law are immediately taken into account as part of non-operating expenses in sub. 2 p. 2 art. 265 Tax Code of the Russian Federation.

Example. Use of the allowance for doubtful debts in the fourth quarter

/ condition / Let's continue our example. Revenue (without VAT) for 2015 - 9,500,000 rubles. The unused balance of the reserve as of October 1, 2015 is 293,000 rubles. The debt of Debtor 3 in the amount of 250,000 rubles. recognized as hopeless in November 2015 due to its liquidation.

/ solution / Debtor 3's debt to repay the loan did not participate in the formation of a "doubtful" reserve. Its amount is included in non-operating expenses.

The results of the inventory of receivables as of December 31, 2015 were as follows:

You have a new debtor, but the existence of this debt is insufficient to include the amount of debt in the created reserve. Therefore, a new reserve is formed only from the debt of Debtor 1 - 293,000 rubles, which is less than the limit of 950,000 rubles. (9,500,000 rubles x 10%). Since the amount of the unused balance of the provision carried over from the previous quarter is equal to the amount of the new provision, no charge is made to the provision on December 31, 2015.

On income tax return losses from writing off bad debts (we have a cumulative total of 170,000 rubles + 250,000 rubles = 420,000 rubles) are reflected in line 302 of Appendix No. 2 to sheet 02, as well as in the total amount in line 300 of Appendix No. 2 to sheet 02. And then the sum of lines 200 and 300 of Appendix No. 2 to sheet 02 is indicated in line 040 of sheet 02.

Pay attention to the formation of the reserve in the first quarter of next year. The fact is that its size will depend on the revenue for January - March, and the transferred balance of last year's reserve was calculated taking into account the revenue for the entire previous year. And it may happen that when adjusting the new reserve created on 03/31/2016 for the unused balance, you will have a difference that will have to be included in non-operating income.

Example. Adjustment of the provision in the first quarter of the next year

/ condition / Let's go back to our example. The organization continues to create a reserve in 2016. Revenue (excluding VAT) for the 1st quarter of 2016 is 1,200,000 rubles. The unused balance of the reserve as of January 1, 2016 is 293,000 rubles.

The delay on debts is more than 90 calendar days, and in the calculation of the reserve we take 100% of doubtful debts - 411,000 rubles. (293,000 rubles + 118,000 rubles).

The limit value of the reserve is calculated based on the revenue of the first quarter. It is equal to 120,000 rubles. (1,200,000 rubles x 10%) and less than the estimated amount of debts (411,000 rubles). We create a new reserve for it.

Next, we adjust the newly created reserve for last year's balance (293,000 rubles). We have a difference in the amount of 173,000 rubles. (293,000 rubles - 120,000 rubles), which must be taken into account on March 31, 2016 in non-operating income.

On income tax return we will reflect this amount in line 100 of Appendix No. 1 to sheet 02 of the declaration along with the rest of non-operating income, and then we will transfer it to line 020 of sheet 02 of the declaration.

If at the end of the year you had an unused reserve for doubtful debts, but in the new year you decided not to create such a reserve, then you need to:

- make appropriate changes to the tax accounting policy;

- include the entire unused amount of the reserve on December 31 of the current year into non-operating income;

- reflect the amount of the restored reserve on line 100 of Appendix No. 1 to sheet 02 of the declaration and on line 020 of sheet 02 of the declaration as part of the total amount of non-operating income in clause 5.2 of the procedure for filling out the declaration, approved. Order of the Federal Tax Service of November 26, 2014 No. ММВ-7-3/ [email protected] .