Accounting account 69 is used to reflect generalized information on the amounts of insurance premiums that the employer pays from the wages of employees. We will talk about the features of organizing accounting for transactions with insurance premiums, as well as about typical postings on account 69, in our article.

An enterprise that pays employees in accordance with concluded employment contracts is obliged to reflect the accrual of insurance premiums for their subsequent transfer to an off-budget fund. Legislation provides for mandatory medical, social and pension insurance for employees. Also, the employer must ensure the payment of insurance premiums in case of occupational diseases and accidents at work.

To reflect the amounts of accrued and paid contributions to off-budget funds, account 69 is used. To analyze and control the amounts of contributions, an organization can open sub-accounts in accordance with the types of transfers made.

Regulatory documents provide that account 69 can be used to reflect the following transactions:

- payment of the amount of contributions (fines, penalties);

- reflection of expenses for contributions to off-budget funds.

It should be noted that on account 69 not only the amounts of obligations to the funds are carried out, but also the transfers from the FSS are made.

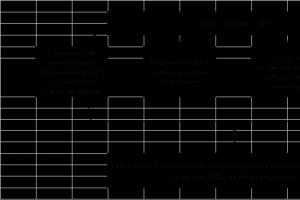

Sub-accounts 69 accounts

Table of typical postings for account 69

The basis for calculating the amount of insurance premiums is the amount of remuneration that is paid to the employee in accordance with the employment contract. The amount of assessments of contributions is carried out according to Kt 69, transfers to extra-budgetary funds are reflected according to Dt 69. Also, according to Kt 69, the amount of contributions received from extra-budgetary funds in favor of the organization can be carried out.

The main transactions on account 69 are reflected in the accounting by the following entries:

An example of postings on account 69

On January 31, 2016, Start LLC made a payment to Sazonov K.R., an employee of the economic department:

- salary - 41,300 rubles;

- sickness benefit - 7,500 rubles. (including for the first 2 days at the expense of the organization - 2,350 rubles).

Paying a salary to Sazonov, the accountant of Start LLC made a calculation of the amount of insurance premiums:

- PFR for the insurance part of the labor pension: 41,300 rubles. x 14.0% = 5782 rubles;

- PFR for the funded part of the labor pension: 41,300 rubles. x 6.0% = 2478 rubles;

- FSS for insurance premiums: 41,300 rubles. x 2.9% = 1198 rubles;

- FSS for contributions to insurance against accidents and occupational diseases: 41,300 rubles. x 0.2% = 83 rubles;

- FFOMS: 41,300 rubles. x 1.1% = 454 rubles;

- TFOMS: 41,300 rubles. x 2.0% = RUB 826

The payment of salaries to Sazonov and the accrual of insurance premiums was reflected by the accountant of Start LLC with the following entries:

| Dt | CT | Description | Sum | Document |

| 91.2 | Salary accrued to Sazonov K.R. | RUB 41,300 | Payroll | |

| 91.2 | Sickness benefit accrued (at the expense of Start LLC) | 2 350 rub. | Payroll | |

| Sickness benefit accrued (at the expense of the state) | 5 150 rub. | Payroll | ||

| 91.2 | The amount of insurance premiums accrued in the FSS | 1198 rub | Payroll | |

| 91.2 | Accrued amount of insurance premiums (accidents and occupational diseases) | 83 rub. | Payroll | |

| 91.2 |

Any employer, be it a firm or an individual entrepreneur, if there are employees, is obliged not only to pay them wages, but also to carry out a set of additional costs associated with mandatory payments for social insurance and the provision of employees. Accounting for such expenses will be discussed in this article.

Social insurance payments

Compulsory insurance expenses for employees include contributions to the Pension Fund, the Medical Insurance Fund and the Social Insurance Fund. From the name of these instances, it is generally clear that deductions to the Pension Fund affect the future pension of an employee, medical contributions finance mandatory compulsory medical insurance programs, and contributions to the Social Insurance Fund enable an employee under an employment contract to claim payment for a period of illness or, say, leave in connection with pregnancy and childbirth or childcare at the expense of the employer. The rates at which contributions to the funds are deducted for most employers are taken at the following level:

- contributions to the PFR - 22%,

- contributions to the MHIF - 5.1%,

- contributions to the Social Insurance Fund in case of temporary disability and in connection with motherhood - 2.9%.

In addition, on the basis of Federal Law No. 125-FZ of July 24, 1998, firms and individual entrepreneurs are required to make contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases. The rate for such contributions ranges from 0.2% to 8.5%, depending on the particular type of activity carried out by the employer and the occupational risk class associated with it. The ratio of the class of professional risk and the insurance rate is established by Article 1 of the Federal Law of December 22, 2005 No. 179-FZ. The level of risk and the corresponding rate for contributions to injuries are annually confirmed by employers in the FSS on the basis of the most profitable type of activity following the results of the past year.

All contributions are accrued from a specific salary, which is calculated for the employee at the end of the month.

Accounting for social insurance and security payments

Organizations that are required to keep accounting records record social insurance settlements under account 69 of the Chart of Accounts. It, in turn, is divided into sub-accounts:

- 69.1 - Calculations for insurance premiums credited to the FSS,

- 69.2 - Calculations for insurance premiums credited to the FIU,

- 69.3 - Calculations for insurance premiums credited to the FFOMS,

- 69.11 - Calculations for compulsory social insurance against industrial accidents and occupational diseases.

The accrual of contributions is reflected on the credit of these accounts, and on the debit they correspond with cost accounts, which calculate the company's total monthly expenses for production or sale, i.e. 20,25, 26, 44. When paying the accrued amount, the credit balance for each of these accounts is written off through the debit of the same account in correspondence with account 51 - Settlement account, and thus the debt to the funds is reset.

Salaries accrued to employees of Alfa LLC in July 2016 amounted to 100,000 rubles. In this regard, the accountant will make the following entries in accounting:

D.20 (or 26.44, etc.) - K. 70 - 100,000 rubles - wages accrued,

D.20 - K. 69.1 - 2900 rubles - social insurance contributions to the FSS have been accrued,

D.20 - K 69.2 - 22,000 rubles - contributions have been accrued for the insurance part of the labor pension in the Pension Fund of the Russian Federation,

D.20. - By 69.3 - 5100 rubles - contributions to the MHIF are accrued,

D.20. - By November 69 - 200 rubles - contributions to the FSS for injuries have been accrued.

D.70 - K.68.1 - 13,000 rubles - personal income tax withheld from the salary of employees,

D.70 - K.51 - 87,000 rubles - wages were paid to employees,

D. 68.1 - K.51 - 13,000 rubles - personal income tax deducted from employees' wages was transferred.

D. 69.1 - K.51 - 2900 rubles - social insurance contributions paid to the FSS,

D. 69.2 - K.51 - 22,000 rubles - contributions were paid to the insurance part of the labor pension in the Pension Fund of the Russian Federation,

D. 69.3 - K.51 - 5100 rubles - contributions to the MHIF were paid,

D. 69.11 - K.51 - 200 rubles - contributions to the FSS for injuries were paid.

Individual entrepreneurs do not keep accounting records, but they carry out social insurance calculations according to the same principle - accruing monthly contributions broken down by individual payments transferred to each of the funds.

Due dates for social security contributions and reporting

Payment of accrued contributions must be made before the 15th day of the month following the settlement month. And here it must be said that there is no such recipient of payments as a medical fund. The PFR is the manager of contributions to the MHIF, that is, it is to the Pension Fund that both pension contributions and medical contributions are transferred. In total, two separate payments in favor of the PFR, and two more - for ordinary social insurance and for injuries - to the FSS. When transferring contributions, it is important to indicate in the purpose of payment the employer's registration number, respectively in the FIU and in the FSS. An important point: by default, these numbers are assigned to companies within a month after registration, but an individual entrepreneur receives them only after registering with the funds as an employer. And here you need to understand that the entrepreneur already has a personal registration number in the FIU by this moment - he pays his own fixed contributions on it. But when paying contributions for employees, it is required to indicate exactly the registration number in the pension fund that was assigned to it as an individual entrepreneur with employees, and not your own.

The same registration numbers in the FIU and the FSS are required to be indicated when reporting. It is submitted to the funds based on the results of a quarter, half a year, 9 months and a year, that is, indicators on wages and accrued contributions are indicated in it on an accrual basis. Both organizations and individual entrepreneurs have uniform reporting deadlines, as well as their forms themselves.

The social insurance report is provided in the form 4-FSS, approved by order of the FSS of Russia dated February 26, 2015 No. 59. In paper form, it is submitted before the 20th day of the month following the ended quarter. Those who report via electronic communication channels are given an extra 5 days to prepare - they can submit a report until the 25th day of the month after the end of the quarter.

Reporting to the Pension Fund in the form RSV-1 PFR (approved by the Resolution of the PFR dated January 16, 2014 No. 2p) includes data on accrued and paid pension contributions and contributions to the MHIF. It is submitted on paper by the 15th day of every second month after the end of the quarter, that is, by May 15, August 15, November 15, February 15. Again, for filing reports in paper form, the period is somewhat reduced. The pension report must be sent electronically by the 20th day of the second month following the reporting quarter.

Account 69 in accounting is a way of reflecting generalized information on the accrual and payment to the budget of amounts intended for social insurance and security. This includes such types of deductions as:

- pension (PF RF);

- social (FSS RF);

- health insurance (FFOMS).

Funds can be transferred at the expense of the employer or deducted from the employee's salary.

About state social funds

It should be noted that as such the concept of UST (single social tax) no longer exists today. Accountants use the acronym out of habit. The tax itself was abolished on January 1, 2010. Instead, mandatory social insurance payments were introduced to the relevant funds. The general principles of accrual and payment remained unchanged.

Consider the main state social insurance funds and their purpose:

- PF - pension fund - off-budget state, designed to pay funds after the end of employment upon reaching retirement age, for length of service or for the loss of a breadwinner.

- FSS - social insurance fund - guarantees payments in case of accidents, payment of sick leaves and benefits for pregnancy and childbirth. In addition, it finances certain types of health resort trips.

- FFOMS - the federal compulsory health insurance fund - allows you to use guaranteed medical care services.

The company transfers funds to each fund separately, for which it opens account 69 and the corresponding sub-account operations.

Accounts 69.00 analytical accounting

In the course of the company's activities, account 69 occupies a special place in accounting. Sub-accounts are opened for the following types of transactions:

- accounting for social insurance of employees (subaccount 69.1);

- accrual and transfer of contributions to the Pension Fund of the Russian Federation (subaccount 69.2);

- payments for compulsory health insurance of employees (subaccount 69.3).

If the organization makes payments for certain categories of social insurance, the company's charter regulates the use of additional sub-accounts of account 69.

The procedure for calculating social benefits

The unified social tax, transferred to the relevant state funds, is calculated based on the employee's salary. It should be borne in mind that deductions are made for any type of income, whether it be a bonus or an official salary.

Mandatory social payments are part of production costs. Payments are made monthly at the scheduled time. The period regulated by the Tax Code of the Russian Federation is the day the money is received from the bank, provided for wages for the month worked. The transfer of social tax funds must be made no later than the 15th day of the following month.

Interest rates

The amount of taxes payable is calculated for each fund separately. The calculation is made on the basis of the tariff rate established by the Tax Code of the Russian Federation. For 2016, the percentage of the amount of payments from the employee's income is:

- Pension fund - 22%.

- Social Insurance Fund - 2.8%.

- Federal Compulsory Medical Insurance Fund - 5.1%.

The total contribution rate will be 30%. Some types of business are taxed at a reduced rate:

- organizations operating under a special regime are taxed at a rate of 20%;

- Skolkovo participants have the right to deduct only 14% to the Pension Fund;

- companies engaged in intellectual activity contribute a total of 14% to all social insurance funds;

- ship crew employers are taxed at a zero rate;

- a reduced tariff of 7.6% is available in Crimea.

It should also be taken into account that exceeding the limit of the base used to calculate insurance payments entails an additional accrual of 10% in the Pension Fund and 5.1% in the FFOMS of the excess amount. For 2016, the maximum amounts for the Social Insurance Fund are set - 723 thousand rubles, and PF - 800 thousand rubles. The rule does not apply to discounted rate users.

Compensation insurance payments

The amount transferred to the FSS of the Russian Federation may be reduced if the employer paid the costs of social insurance of employees at the expense of the enterprise. This includes allowances:

- on sick leave;

- maternity payments;

- lump-sum payment at the birth of a child;

- childcare up to 1 year 6 months;

- upon adoption;

- caring for a disabled child;

- social funeral payment.

In addition, the legislation establishes the purchase of vouchers for sanatorium and preventive treatment at the expense of the Social Insurance Fund (the fund restores the company's costs). It should be borne in mind that not all categories of citizens are included in the list.

Changes in operations on account 69 in 2016

Account 69 reflects many business transactions, and any legislative change in the rules for calculating payments must be taken into account by the auditor. From this year, the following requirements have come into force:

- the amount paid to the employee upon dismissal is not subject to UST only if it does not exceed three times the average monthly income;

- abolished the deduction of social payments from travel expenses;

- transfers to the Pension Fund from the income of foreign workers became mandatory.

In case of non-compliance with the rules, administrative liability measures are applied to the employer.

Account 69 in accounting: structure

The account for social insurance payments is passive: credit is credited, and funds are debited. Unlike many other enterprise source accounts, account 69 is characterized by an expanded balance. This means that at the end of the reporting period, the accountant calculates both the credit balance and the debit balance.

It turns out that account 69 in the balance sheet is reflected both in the asset and in the liability. Sections where you can find account information:

- "Current assets" (article "Other debtors").

- "Short-term liabilities" (article "Debt to state. non-budgetary funds").

The accrual of amounts can be seen in the debit of production accounts, which reflect the wages of employees. One account is always credited - 69.

Characteristics of the balance on the debit of account 69

The opening and closing balances recorded in the financial statements of an enterprise contain valuable information about social contributions. Consider the characteristics of the debit opening balance:

- Indicates the amount of debtors' debt under the UST - the total amount of money paid to the employee at the expense of the FSS of the Russian Federation.

- Shows the process of transferring social tax to budget funds.

- Reflects the accrual of social benefits at the expense of state insurance.

The closing balance in the debit of account 69 sums up the amount of the state's receivables to the enterprise. The reason for the formation of the balance at the end of the reporting period is the need to reimburse the amount of social insurance paid by the enterprise or overpayment of the UST.

Credit balance of account 69

According to the credit of the account, social insurance tax is charged, therefore, the initial balance in the loan will indicate the presence of debt to the state under the UST. Each of the sub-accounts has a separate balance, which makes it easy to see exactly which payments have not been made.

At the end of the reporting period, the credit balance indicates the total amount of debt on mandatory payments to the budget and the Pension Fund. After the calculation, the data are transferred to the liabilities side of the balance sheet and reflected in the financial statements of the enterprise.

Account entries 69

Errors in the preparation of account assignments lead to inconsistencies in the balance sheet indicators. As an example, consider the correspondence of accounts for possible business transactions of an enterprise.

It is necessary to clearly distinguish between debited accounts when calculating social benefits. For employees of the main production, only account 20 can be used. The salary of the administration and, accordingly, social charges are reflected in account 26.

Account 69 in accounting is subject to thorough checks by the tax service and is one of the main indicators of the financial situation at the enterprise.

Account 69 "Calculations for social insurance and security" is intended to summarize information on the calculations for social insurance, pension provision and compulsory health insurance of employees of the organization.To account 69 "Settlements for social insurance and security" sub-accounts can be opened:

69-1 "Calculations for social insurance";

69-2 "Calculations for pensions";

69-3 "Calculations for compulsory health insurance".

On sub-account 69-1 "Calculations for social insurance", calculations for social insurance of employees of the organization are taken into account.

Sub-account 69-2 “Calculations for pension provision” takes into account the calculations for the pension provision of the employees of the organization.

Sub-account 69-3 “Settlements for compulsory medical insurance” takes into account settlements for compulsory medical insurance of employees of the organization.

If the organization has settlements for other types of social insurance and security, additional sub-accounts may be opened to account 69 “Calculations for social insurance and security”.

Account 69 “Calculations for social insurance and security” is credited for the amount of payments for social insurance and security for employees, as well as their compulsory health insurance, subject to transfer to the appropriate funds. In this case, the entries are made in correspondence with:

accounts that reflect the accrual of wages, - in terms of deductions made at the expense of the organization;

account 70 “Settlements with personnel for wages” - in terms of deductions made at the expense of employees of the organization.

In addition, on the credit of account 69 “Settlements for social insurance and security”, in correspondence with the profit and loss account or settlements with employees on other transactions (in terms of settlements with guilty persons), the accrued amount of penalties for late payment of payments is reflected, and in correspondence with account 51 "Settlement accounts" - the amounts received in cases of excess of the corresponding expenses over payments.

The debit of account 69 “Settlements for social insurance and security” reflects the transferred amounts of payments, as well as the amounts paid out of payments for social insurance, pensions, and compulsory medical insurance.

The credit of this account shows the debt of the organization to the bodies of social insurance and provision of citizens.

This debt is formed at the expense of the enterprise. At the same time, accounts are debited, which reflect the accrual of wages, or account 99 “Profit and Loss” (in terms of penalties and fines).

Account 69 "Social insurance and security settlements" usually has a credit balance, which means the organization's debt, and may also have a debit balance, which

vanishing in the event of the formation of debts of social insurance bodies and security to the enterprise. A debit balance usually appears in social insurance calculations when the amount of contributions due from the enterprise turns out to be less than the amounts paid to employees from social insurance payments (temporary disability benefits, maternity benefits, etc.)

Analytical accounting on account 69 “Calculations for social insurance and security” is carried out in the context of each type of calculation.

In the explanations to this account, it is noted that if the organization has settlements for other types of social insurance and security, additional sub-accounts may be opened. An example of such a case can be a sub-account for calculations for compulsory social insurance against industrial accidents and occupational diseases.

More on the topic Account 69 "Calculations for social insurance and security":

- ACCOUNTING FOR SOCIAL INSURANCE AND SECURITY PAYMENTS

- 8.5. Accounting for social insurance and security payments (account 69)

- Accounting for settlements with personnel for wages, settlements for other operations and social insurance

- ACCOUNTING FOR PAYROLL AND SOCIAL INSURANCE CALCULATIONS

- Federal Law of December 29, 2006 No. 255-FZ “On the provision of benefits for temporary disability, pregnancy and childbirth of citizens subject to compulsory social insurance”.

- Social prospects, social goals, social opportunities, social risks and the state as a resource for their provision, mobilization or prevention (minimization)

Account 69 "Calculations for social insurance and security" is intended to summarize information on payments for social insurance, pensions and compulsory health insurance of employees of the organization.

To account 69 "Calculations for social insurance and security" sub-accounts can be opened:

69-1 "Calculations for social insurance",

69-2 "Calculations for pensions",

69-3 "Calculations for compulsory health insurance".

Sub-account 69-1 "Social insurance settlements" takes into account social insurance settlements for employees of the organization.

On sub-account 69-2 "Calculations for pensions" the calculations for pensions for employees of the organization are taken into account.

Sub-account 69-3 "Settlements for compulsory medical insurance" takes into account the calculations for compulsory medical insurance of employees of the organization.

If the organization has settlements for other types of social insurance and security to account 69 "Calculations for social insurance and security", additional sub-accounts may be opened.

Account 69 "Settlements for social insurance and security" is credited for the amount of payments for social insurance and security of employees, as well as their compulsory health insurance, subject to transfer to the appropriate funds. In this case, the entries are made in correspondence with:

accounts that reflect the accrual of wages - in terms of deductions made at the expense of the organization;

score 70"Settlements with personnel for wages" - in terms of deductions made at the expense of employees of the organization.

In addition, on the credit of account 69 "Settlements for social insurance and security", in correspondence with the profit and loss account or settlements with employees on other transactions (in terms of settlements with guilty persons), the accrued amount of penalties for late payment of payments is reflected, and in correspondence with score 51"Settlement accounts" - the amounts received in cases of excess of the corresponding expenses over payments.

The debit of account 69 "Calculations for social insurance and security" reflects the transferred amounts of payments, as well as the amounts paid out of payments for social insurance, pensions, and compulsory medical insurance.

Account 69 "Calculations for social insurance and security"

corresponds with accounts

| by debit | on credit |

|

50 Checkout 51 Settlement accounts 52 Currency accounts 55 Special bank accounts |

08 Investments in non-current assets 20 Main production 23 Ancillary industries 25 General production expenses 26 General expenses 28 Manufacturing defects 29 Service industries and farms 44 Selling expenses 51 Settlement accounts 52 Currency accounts 70 Settlements with personnel for wages 73 Settlements with personnel for other transactions 91 Other income and expenses 96 Provisions for future expenses 97 Deferred expenses 99 Gains and Losses |

Chart of accounts application: account 69

- How to refund overpayment on taxes and fees

It is necessary to analyze account 68 "Calculations on taxes and fees." Having generated an analysis of the account according to the ones indicated in Fig. a certificate on the status of calculations for taxes, fees and insurance premiums ... are reflected in account 69 "Calculations for social insurance and security". Similarly to account 68, we check the data on account 69. Fig. 3 ...

- How to reflect in the accounting penalties and fines for late payment of insurance premiums?

Expenses are subject to crediting to the profit and loss account of the organization, except in cases ... in accordance with the Instructions for the Application of the Chart of Accounts for Financial and Economic Accounting ... it is also indicated that the credit of account 69 "Calculations for social insurance and security" in correspondence .. ... with a profit or loss account ... on account 99 "Profit and Loss" in correspondence with account 69. ...

- Reporting for 2016: how to correctly take into account the annual clarifications of the Ministry of Finance

Profit, it is reflected in the debit of account 99 “Profit and Loss” and credit 96 “Reserves ... tax sanctions on them are reflected in the debit of account 99 “Profit and Loss”. Fines and penalties ... for social purposes, development of production, etc. do not change the balance of account 84, and in no way ... the funds are reflected in account 76 “Settlements with various debtors and creditors” (a letter from the Ministry of Finance ... is needed on account 69 "Calculations for social insurance and security", as before. Recording of a seminar on the topic "Insurance ...

- Correcting errors in accounting policies: estimated liabilities and values

An entry in the debit of account 63 in correspondence with the corresponding accounts for accounting for settlements with ... debtors 60 (62, 76, 66, 67, etc. ... and insurance premiums is reflected in the debit of account 96 and the credit of accounts 70 "Settlements with personnel for .. . wages", 69 ... "Calculations for social insurance and security ...

- How can an au pair create a reserve for vacation pay?

Credit of account 70 "Settlements with personnel for wages" and the corresponding sub-accounts of account 69 "Expenses for social insurance and security." Since ... how accruals are carried out for ... production workers and managers ...

- Capital construction on its own: reflection in accounting

The organization, on its own, at its own expense, carries out capital construction ... on the corresponding sub-account opened for account 08 "Investments in ... non-current assets". Corresponding accounts can be accounts 02 "Depreciation of the main ... Settlements with suppliers and contractors", 69 "Calculations for social insurance and security", 70 "Settlements with personnel for ... the corresponding reporting period for VAT on the basis of the invoice, the accrual is reflected ...

- Employee sickness benefit: calculation and accounting rules in 2019

The course of which insurance premiums for compulsory social insurance were accrued and paid in case of a temporary ... billing period: in 2017 - 69,300 rubles; in 2018 ... earnings will be 230.14 rubles. ((69,300 + 98,700) rubles / 730 ... expenses were made at the expense of subsidies for financial support for the implementation of the state task ... using account 0 302 66 000 “Calculations for social benefits and compensation to personnel in ...

- Getting ready to pay insurance premiums in a new way

Deadlines and in full. To do this, they check the balance of account 69 in ... set off against future payments for compulsory social insurance in case of temporary disability and in ... security for social insurance against industrial accidents and occupational diseases. For your information Calculation form for ... 2016 the following activities: inventory of account 69, as well as verification of data compliance ...

- Changes in 2017 for budgetary institutions

Personal income tax Insurance premiums Personalized accounting Accident insurance Tax on ... all types of damage are reflected in account 209.00 "Calculations for damage and other income" (signed ... separately for own income, subsidies, compulsory medical insurance funds and in temporary disposal (p. 69 ..., business trips); payments for child care; insurance premiums; social and other payments to the population ... columns 5: "subsidies for financial support for the implementation of the state (municipal) task" "subsidies ...

- Payment for vacation at the expense of the created reserve

Social insurance is reflected in the credit of the account 0 401 60 000 and the debit of the accounts... . 160.1 Instructions No. 174n). Recommendations for calculating the "vacation" reserve are given in the Letter ... quarter.); for the payment of insurance premiums - 69,745.09 rubles ... 119 "Compulsory social insurance contributions for payments on remuneration of employees and other payments ... regardless of the source of financial support for these payments and is spent only to cover ...

- Individual entrepreneurs - "simplifiers" and courts against the FIU

Decreased, penalties decreased to 611.69 rubles. About the consequences of those taken ... by the first instance. The basis for calculating insurance premiums is 2017. And, of course, the question arises... of mandatory insurance coverage for mandatory pension insurance, including at the expense of pension funds... a "simplified" tax declaration - to charge additional insurance premiums for mandatory pension insurance and ... The Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Fund ...

- Accounting methodology in ferrous and non-ferrous metallurgy

They are intended to provide uniform methods of planning, accounting and costing ... for maintenance of production and management, are reflected in the account "Main production". Analytical accounting for this account ... funds for social needs; - the cost of repairs and maintenance ... personnel); - fees and deductions (property insurance, interest on loans, bank payments ... -1 10, 70, 69 The costs of the auxiliary unit are shown, ... , prices are set at which settlements are made with buyers. In addition ...

- Summer package of tax amendments

twenty%; for compulsory social insurance in case of temporary disability and in connection with ... "On the basics of compulsory social insurance." The adopted innovations are aimed at ensuring the stabilization established in ... or on account of the payment of tax arrears or debts on the relevant penalties and interest ... by the law of March 31, 1999 No. 69-FZ “On gas supply in the Russian .... 386 of the Tax Code of the Russian Federation, tax calculations for advance tax payments and tax declaration (p...

- Audit of financial statements of a budgetary institution

An organization, a clearing organization, a mutual insurance society, a trade organizer, a non-state pension ... health, culture, social protection, employment, physical culture and sports, and ... 4 tbsp. 69.2 of the RF BC, a subsidy for financial support for the implementation of state ... must correspond in volume and purpose to the standard costs used in calculating the amount of the subsidy ... institutions are required to make purchases at the expense of subsidies provided from ...

- On the procedure for filling out the calculation of insurance premiums, taking into account payments for sick leave

Insurance premiums on account of payment of insurance premiums for temporary disability and in connection with ... on the issue of filling out the calculation of insurance premiums, reports the following. The calculation of insurance premiums (hereinafter referred to as the Calculation) is submitted for ... for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection ... with the territorial bodies of the FSS in the amount of 69,399.1 rubles, then, respectively ...